There is no doubt that maize carryover stocks will reach near-record highs this season (the 2021/2022 marketing season). Given the unpredictability of growing seasons in South Africa, carryover stock has never been much of a problem.

Although the balance sheet on stocks is normally taken as a snapshot at the end of April each year, the bulk of the crop has usually been harvested by the end of July or sometimes early August. It then has to be stored and financed until approximately May of the following year, when the new harvest starts.

Carryover stock

It has happened more than once that either hectares planted were scaled back in the new season, or production circumstances were sub-optimal. In such a case “high” carryover stocks were easily incorporated into the next season. However, this season and leading into next year, it may be different for several reasons.

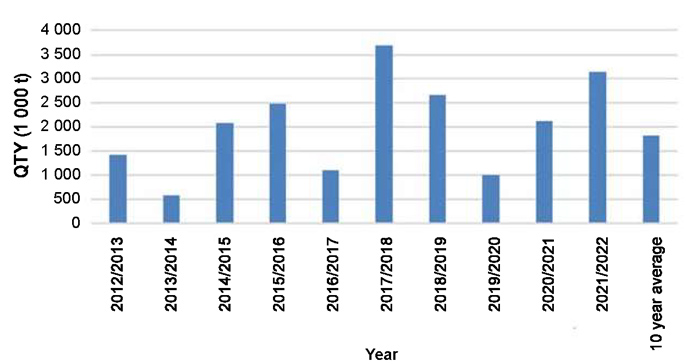

- Firstly, the size of the surplus is significantly more than in the previous three years. The previous record carryover stock was in 2017/2018 (30 April 2018), with 3,69 million tons. This year (30 April 2022) a carryover of 3,14 million tons is forecasted by the NAMC, based on a crop estimate of 16,23 million tons (Graph 1).

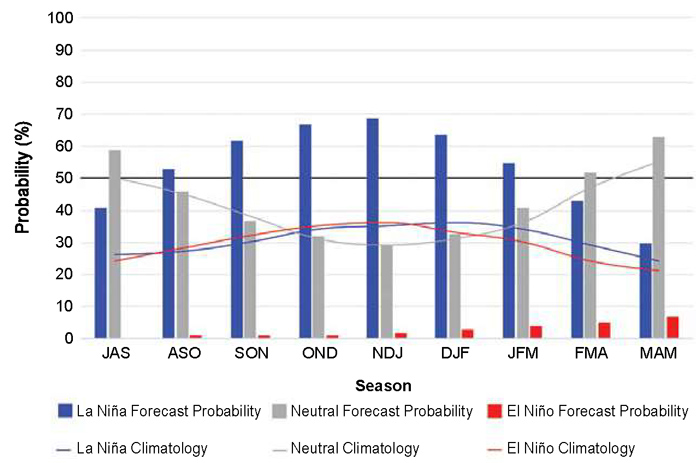

- Secondly, early weather predictions are already indicating that South Africa may see another La Niña growing season coming up (Graph 2). The blue bars indicate a >50% probability for La Niña conditions for most of the growing season. Historically speaking, El Niño and La Niña events tend to develop during April to June, and then typically persist for nine to twelve months. This could possibly lead to another surplus crop.

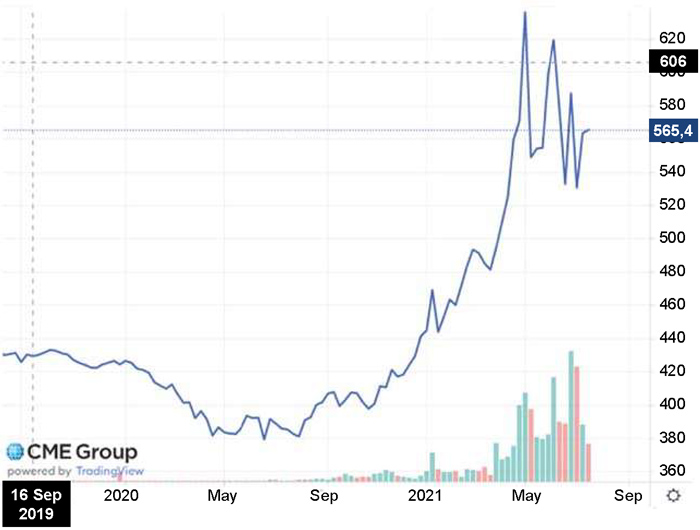

- Thirdly, if we look one year ahead to futures prices, local prices using Safex July 2022 white maize as a reference, are relatively high. This means that there is no reason why producers will scale back on hectares planted (Graph 3). Overseas prices also remain high, mainly because of the uncertainty in the United States of America (USA) weather patterns and the final outcome of their crop. It may still decline, but it is unlikely that such decline will be drastic enough to have a significant negative impact on hectares planted in South Africa during October through to early December 2021.

- Fourthly, export slots have been fully utilised to date. There may be some more opportunity in the fourth quarter of the year, but for additional maize to be exported, prices have to decline to export parity. At the time of writing this article (22 July) local prices for yellow maize were trading at about US$5 above export parity. It is unlikely that we will see a sharp decline in prices below export parity, thereby allowing for substantial additional exports. A good start to the new planting season may change this scenario, but only towards the end of the year. To make things worse, the demand from Africa is also at an all-time low, given the fact that most African countries produced a surplus themselves this season. We are already seeing maize from Zambia being exported to South Africa.

Source: Sagis, 2021

Source: IRICS, 2021

Weekly candles drawn on 22 July 2022.

Carry cost

When evaluating carryover stocks, there are two elements at stake. Firstly, the volumes as already discussed above. The second element is what the market is willing to pay for the stocks to be stored. This is generally referred to as the ‘carry cost’.

The carry cost consists of the storage cost and financing cost. In terms of the futures market, it is also referred to as the ‘calendar month spread’. This is the forward futures contract month minus the near-contract month. In theory, the September price will be higher than July, and December will again be higher than September, etc. Thus, whoever owns the stock will be fully or partially compensated for storing the stock going forward.

However, when the carryover stocks are high, meaning large volumes are carried into the next season (Graph 4), the price in July 2022 is not necessarily higher than in July 2021. The market knows there are plenty of stocks that can go nowhere. Whoever then owns the stock, will not be compensated for storing and financing the stock.

Weekly line chart drawn on 22 July 2021

The reality is that traders then tend not to own physical stock and millers/processors tend to buy from hand to mouth, since it is cheaper than paying the storage and financing cost. Producers then end up owning the stock and have to pay for the storage cost from their own pocket, without being compensated by the market.

This should not be confused with the possibility that the market prices could increase while storing the stock and more than compensate the farmer for the carry cost. However, if the price does not increase, or even declines, the producer will be in the unfortunate position to not only receive the same or less for his product at the time of selling, but also having to bear the carry cost.

There was one exception in the recent history in 2017/2018, see Graph 5 – yellow line (2017/2018 was the last time South Africa had such large carryover stock compatible to this year). The price spread between July 2017 white maize and that of July 2018 was about R245 per ton.

Source: Reuters, 2021

With the annual storage cost at about R95 per ton at the time and financing at about R150 per ton (depending on the period), the market paid for owners of the product to store it. In particular, it paid for traders (including trading divisions of agribusinesses) to buy stock and hedge it forward for twelve months.

This season (blue line) is different. The white maize spread is only trading at about R80 to R100 per ton, which does not even cover the annual storage cost of about R120 per ton at most agribusinesses.

Clearly, and unlike 2017/2018, there is no incentive for traders to purchase stock unless the spread opens. Why would it open? Only if producers start selling in the cash market, for the same reason as traders – they do not want to carry the stock – it is too costly. Another reason may be that since maize prices are fairly close to export parity, speculators may start buying futures in the far months, December 2021 and March 2022.

Selling pressure in the cash months and demand in the far months will lead to the spread opening up. But until such time, those producers believing that prices may further increase should consider selling the physical stock and buying a futures contract or call option – it will be cheaper than paying the storage and financing cost of the physical stock.

References

IRICS, 2021. International Research Institute for Climate and Society. Earth Institute, Columbia University

JSE, 2021 maize prices. Various

NAMC, 2021. SA S&D projections for February 2021. 2 March 2021. Pretoria

Reuters, 2021 price spreads – July 2016/2017 and 2020/2021

SAGIS, 2021 ending stocks. Various