The report opts to aid in a timely basis to foresee external market and other factors that may have an impact on any business and clients.

External factors

The main focus of this document is to have a closer look at external factors which can affect any business and our customers.

1. GRAIN ENDING STOCK MARKET

The National Agricultural Marketing Council (NAMC) predicts 30 April 2022 ending stock for white and yellow maize to exceed that of the 2020/21 season. Their forecast for white maize for the season is that of an excellent harvest. The estimated maize crop is 6% bigger than the 2020 crop. The three main maize producing areas, namely the Free State, Mpumalanga and North West are expected to produce 84% of the 2021 crop.

The repo rate has been cut by 300 basis points this year to help mitigate the economic fallout of the COVID-19 pandemic. The repo rate is currently 3,5% and the prime lending rate 7%.

2. MARKET RISK

2.1 Grain market analysis

-

- Ending stock – national

Ending stock data is gathered from the National Agricultural Marketing Council, also known as NAMC. The estimates are reassessed and reported by the Grain & Oilseeds Supply and Demand Estimates Committee.

The following is a summary of the September 2021 ending stock estimates for the 2020/2021 season:

- Wheat = 419 508 tons

The following is a summary of the February 2022 ending stock estimates for the 2021/2022 season:

- Sunflower = 52 304 tons

- Soybeans = 324 603 tons

- Sorghum = 66 820 tons

The following is a summary of the April 2022 ending stock estimates for the 2021/2022 season in tonnages:

- White maize = 2 286 740 tons

- Yellow maize = 837 197 tons

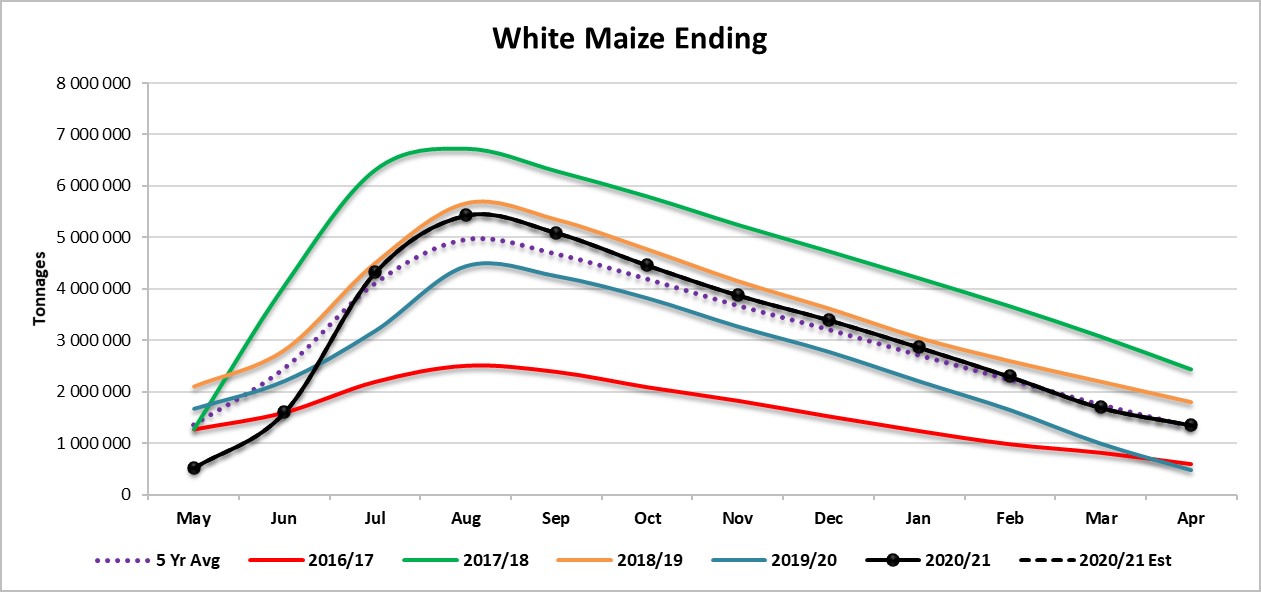

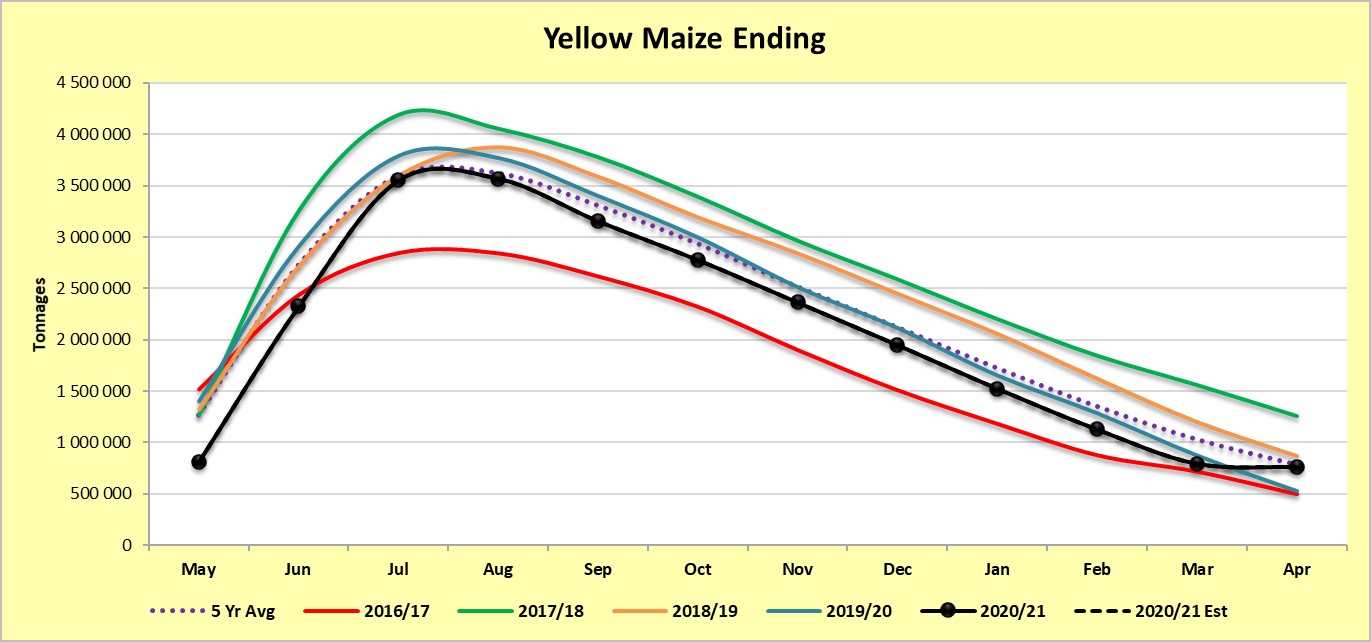

Graph 1 shows the white maize ending stock for April 2021 that is 881 625 tons (or 186%) more than the 2019/2020 season. Yellow maize shows an increase of 234 519 tons (or 45%) in ending stock estimation for the 2020/2021 season over the previous season (Graph 2).

Source: Sagis

Source: Sagis

Source: Sagis

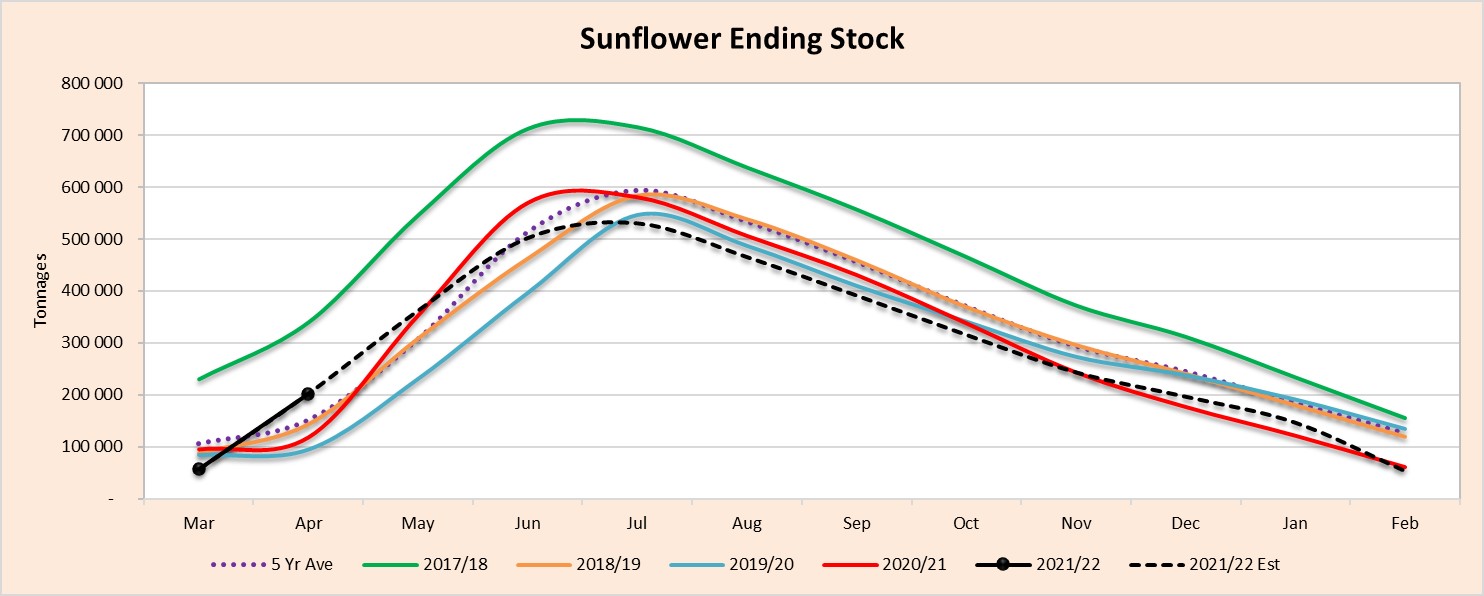

The actual soya ending stock for February 2022 is 278 550 tons more than for February 2021 (Graph 3). The actual sunflower ending stock is 14% (8 660 tons) less than the previous seasons ending stock (Graph 4).

Source: Sagis

- Crop estimations

According to the Crop Estimates Committee (CEC) the size of the expected commercial maize crop has been set at 16,180 million tons, which is 0,53% or 84 750 tons more than the previous forecast of 16,096 million tons.

The area estimate for maize is 2,755 million hectares, while the expected yield is 5,87 t/ha. The estimated maize crop is 6% bigger than the 2020 crop. The three main maize producing areas, namely the Free State, Mpumalanga and North West are expected to produce 84% of the 2021 crop.

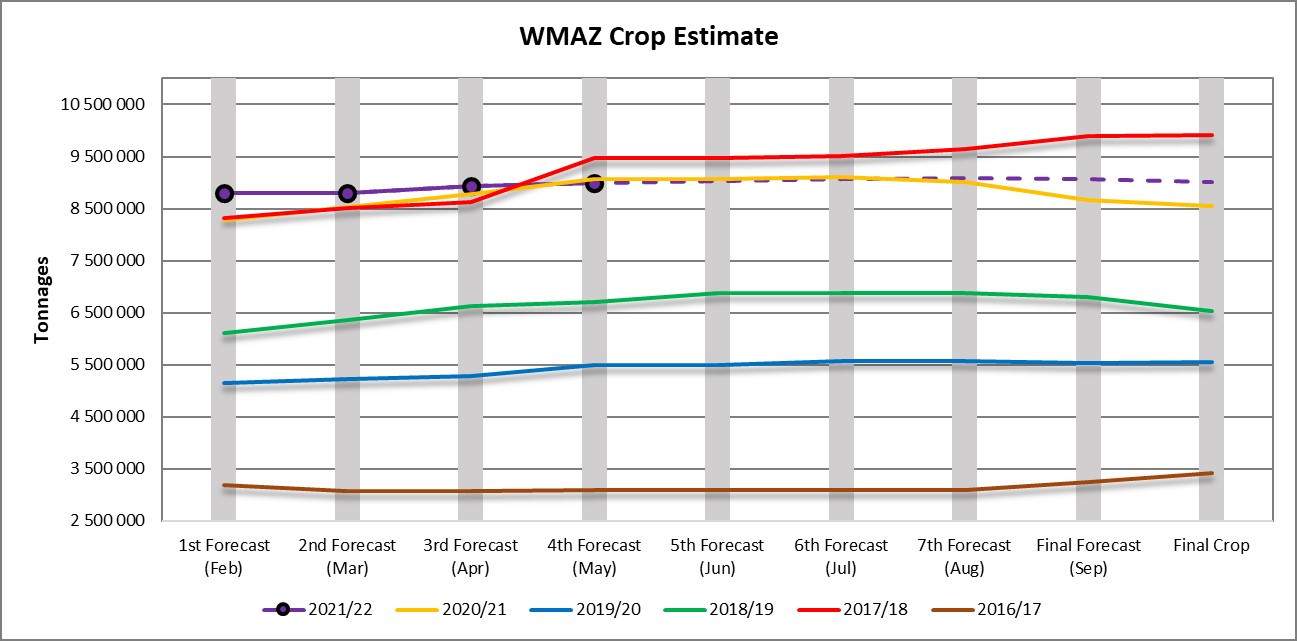

The area estimate for white maize is 1,692 million hectares and for yellow maize 1,064 million hectares (Graph 5). The production forecast of white maize is 8,982 million tons, which is 0,54% or 48 500 tons more than the 8,934 million tons of the previous forecast (Graph 6). The yield for white maize is 5,31 t/ha. In the case of yellow maize, the production forecast is 7,198 million tons, which is 0,51% or 36 250 tons more than the 7,162 million tons of the previous forecast. The yield for yellow maize is 6,77 t/ha.

Source: CEC

Source: CEC

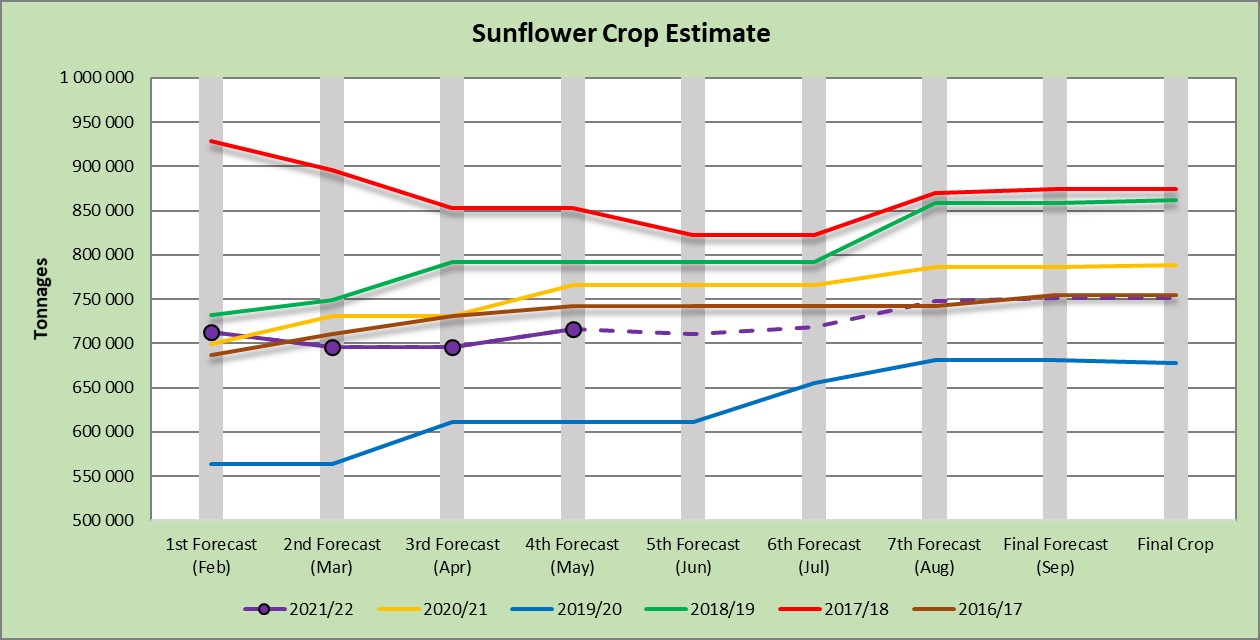

The production forecast for sunflower seed is 716 240 tons, which is 2,87% or 19 950 tons more than the 696 290 tons of the previous forecast. The area estimates for sunflower seed is 477 800 ha, while the expected yield is 1,50 t/ha (Graph 7).

Source: CEC

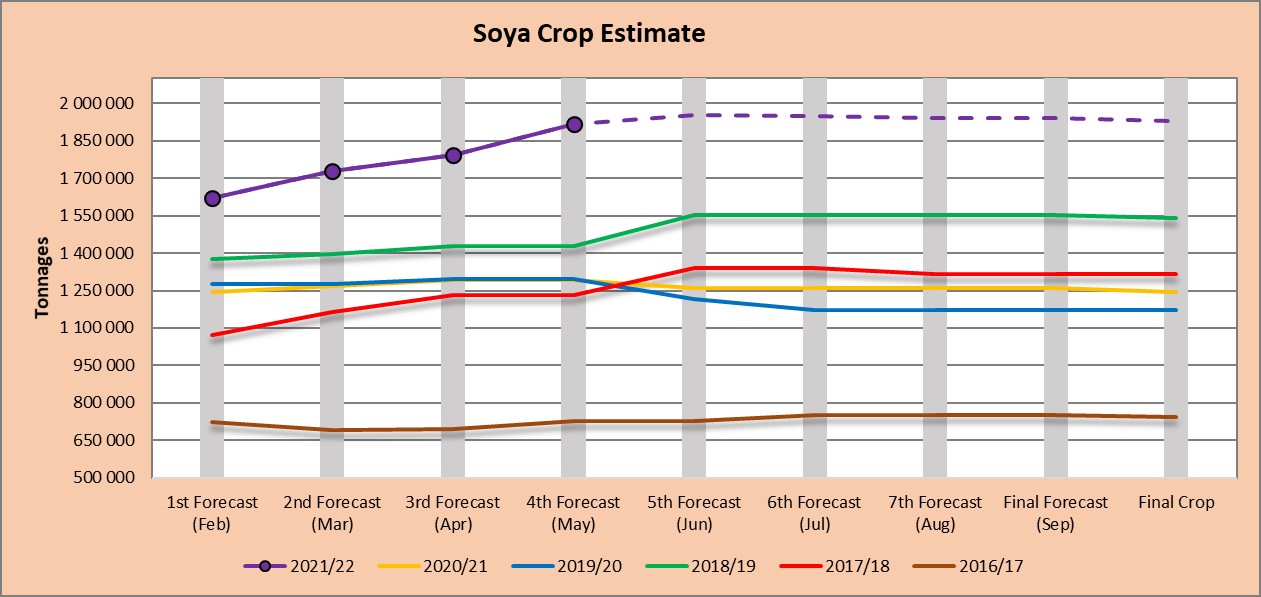

The production forecast for soybeans increased by 6,94% or 124 500 tons to 1,918 million tons. The estimated area planted to soybeans is 827 100 hectares and the expected yield is 2,32 t/ha (Graph 8).

Source: CEC

- Imports and exports – national

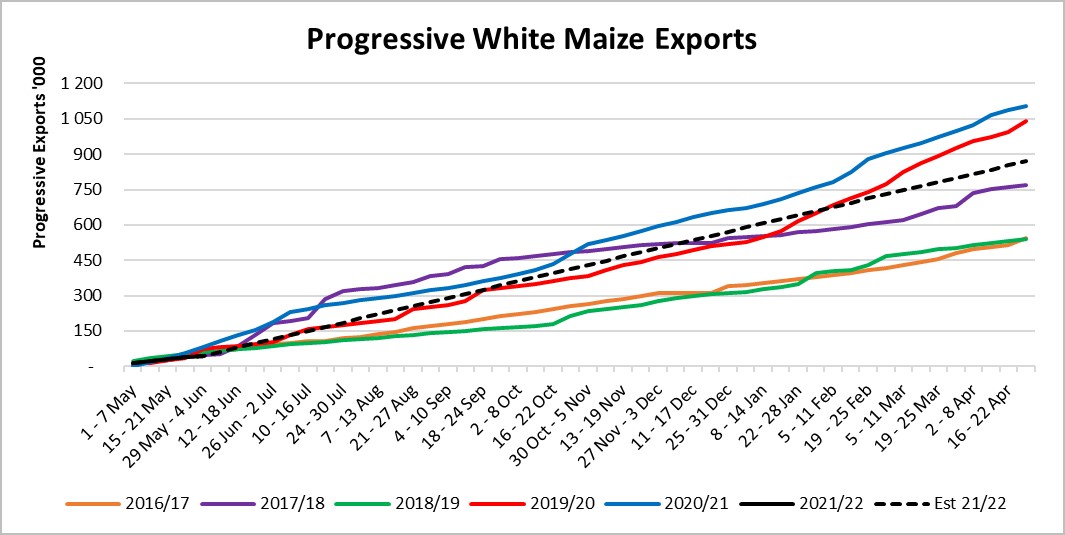

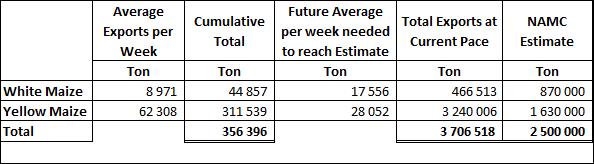

To date, 44 857 tons of white maize and 311 539 tons of yellow maize have been exported since the beginning of May 2021.

Source: Sagis

As seen in Table 1, the average white maize exports per week are currently 8 971 tons. If theoretically, white maize exports remain at the current average of 8 971 tons per week, there would be 403 487 tons less white maize exports than anticipated.

The average yellow maize exports per week are currently 62 308 tons. If theoretically, yellow maize exports remain at the current average of 62 308 tons per week then there would be 1 610 006 tons more yellow maize exports than anticipated (Graph 10).

Source: Sagis

- Parity prices

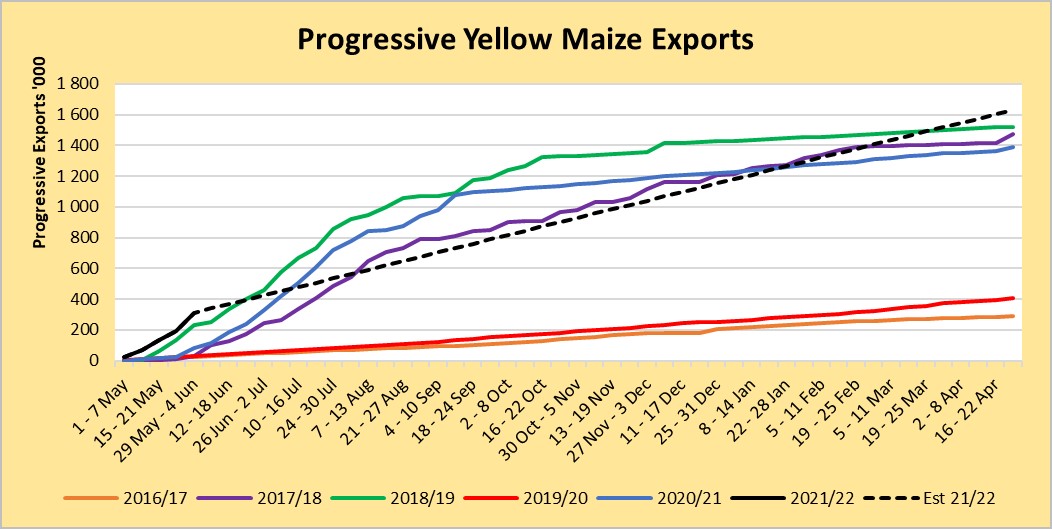

South Africa is a small producer compared to other countries and is thus a price taker (meaning that we cannot influence world prices). Because of this, our local prices are normally between import and export parity, which is illustrated in Graph 11.

An import parity price is defined as the price that a buyer will pay to buy the product on the world market. This price will include all the costs incurred to get the product delivered at the buyer’s destination.

An export parity price is defined as the price that a local seller could receive by selling his product on the world market, for example, excluding the export costs. The price which the seller obtains, is based on the condition that he delivers the product at the nearest export point (usually a harbour) at his own expense.

Source: Grain SA (No further import and export parity data available for white maize)

- Producer deliveries – provincial

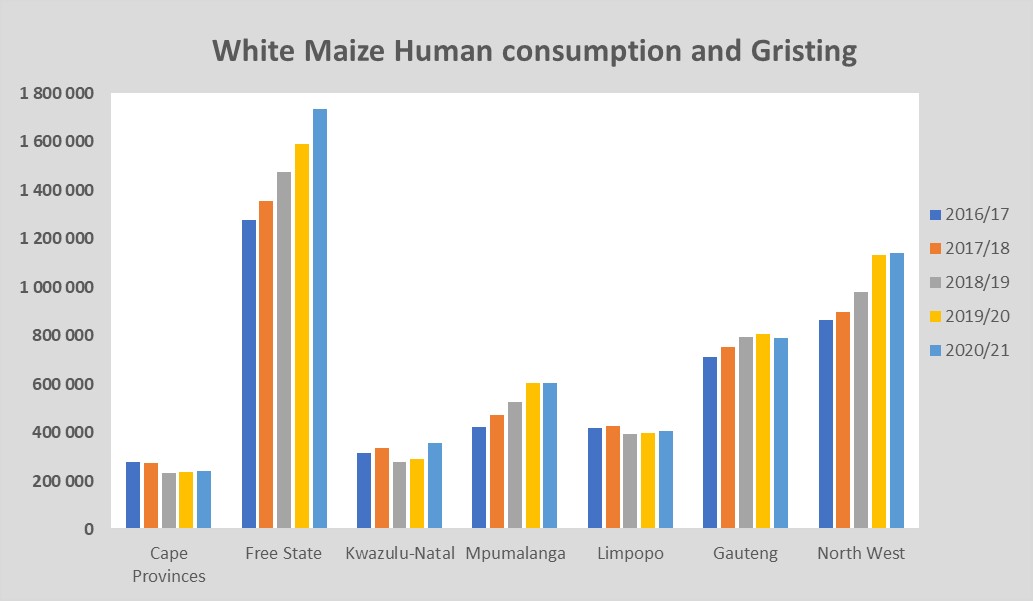

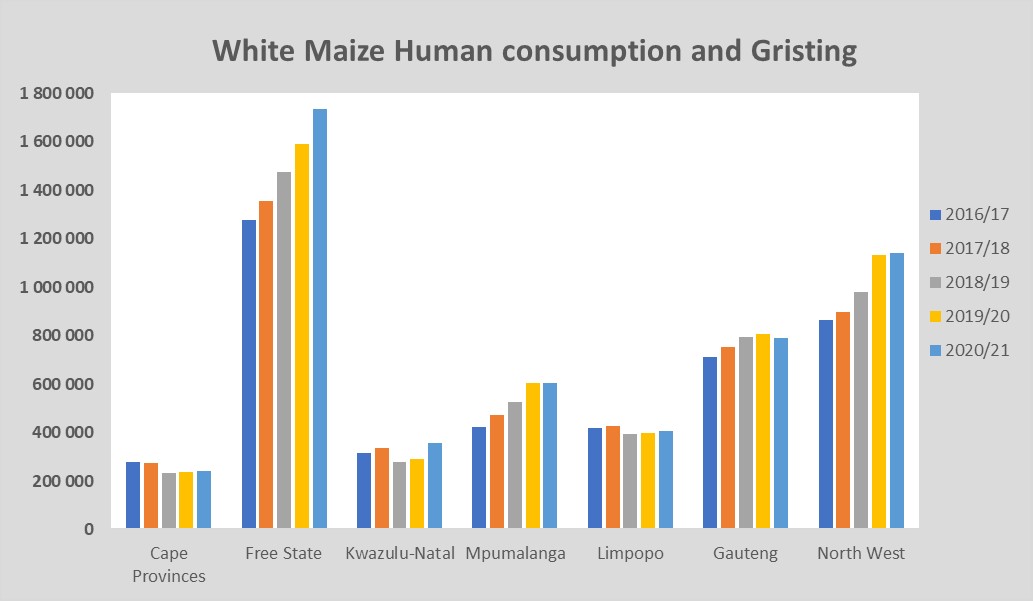

For the marketing year which is May to April the Free State dominates the white maize that is used for human consumption and gristing. North West showed a significant increase for the 2020/2021 season with a 1% rise over the previous season (Graph 12).

Source: Sagis

North West has a decreasing trend in yellow maize used for consumption and gristing. Only 18 563 tons of yellow maize was used in the 2020/2021 season that ended April 2021 (Graph 13).

Source: Sagis

- Exchange rate

NWK Group is exposed to foreign exchange rate risk in various business areas, such as commodity prices and trade imports.

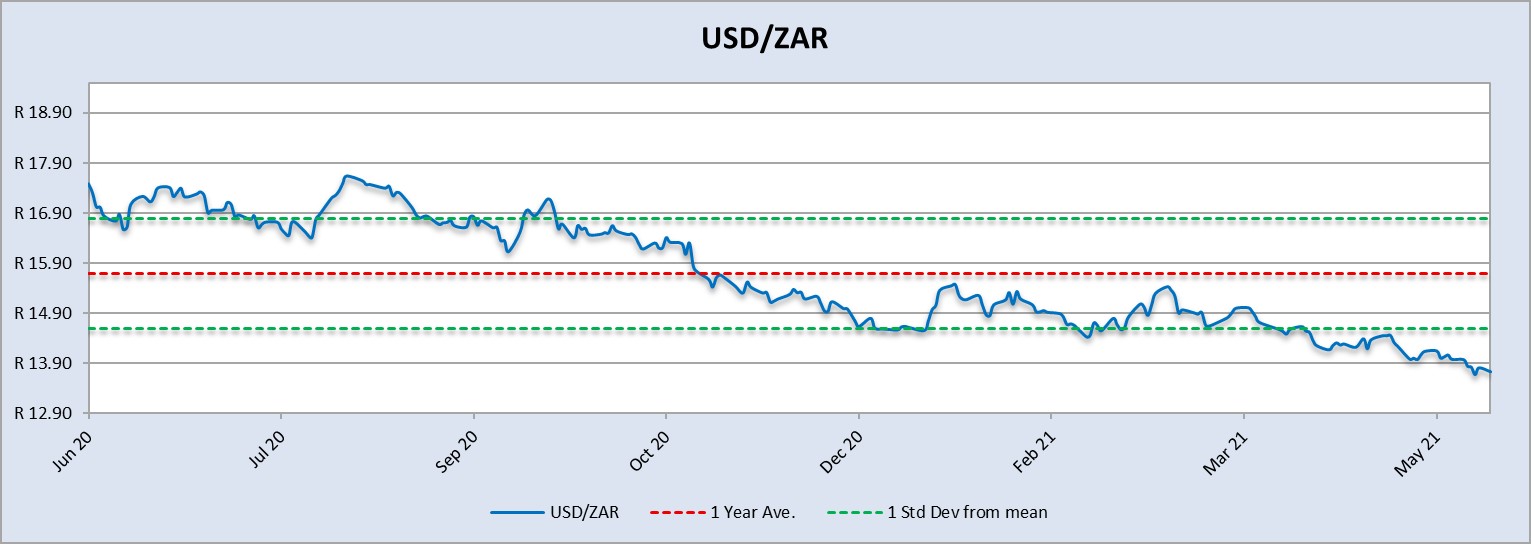

On a monthly average basis, the rand appreciated against the US dollar with 2,4% (0,35c) over the period April 2021 to May 2021. The one-year average for rand/US dollar is R15,70. Moreover, the average rand/US dollar exchange rate for the period May 2021 was R14,06 compared to R14,41 of April 2021 (Graph 14).

According to Nedbank economists the key drivers for the rand that is at a 16-month high against the US dollar were strong global risk appetites, a weaker US dollar, robust commodity prices, better-than-expected domestic fiscal outcomes and encouraging signs that the ruling party started to take action against corruption within its ranks.

Source: Standard Bank, Corporate and Investment Banking and SARB.

- Exchange rate forecast

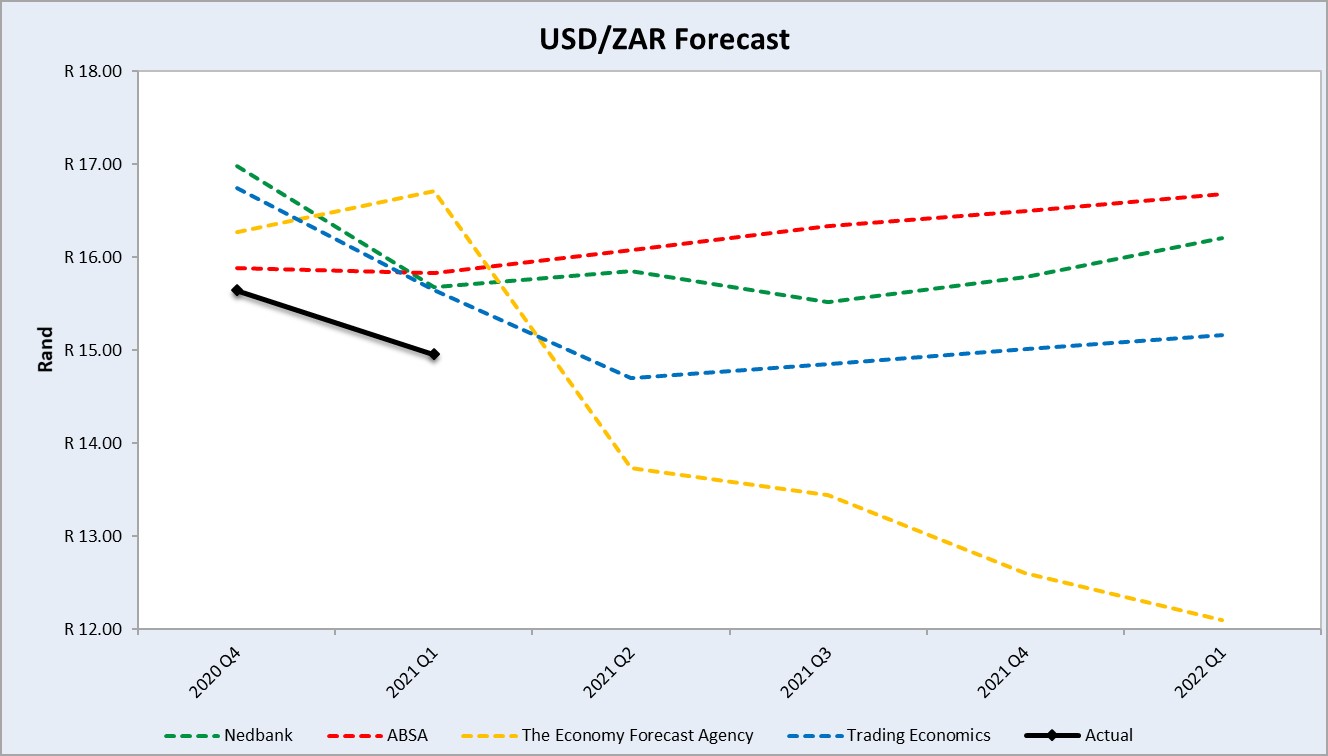

Graph 15 shows the actual USD/ZAR for 2020 quarter 4 (Q4) and 2021 quarter 1 (Q1) against the forecasted figures. Absa’s forecast for 2020 Q4 was the closest to actual and Trading Economics were the closest for 2021 Q1. According to The Economic Forecast Agency, the rand will strengthen a lot in the year 2021.

Source: Nedbank CIB; Absa; The Economic Forecast Agency; Trading Economics

- Future prices

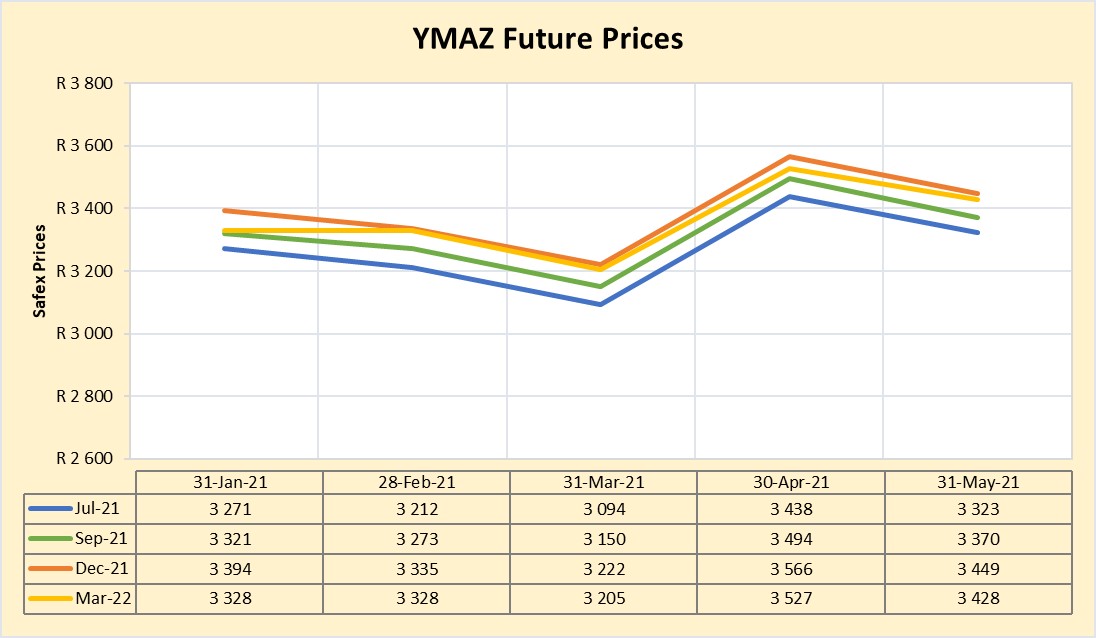

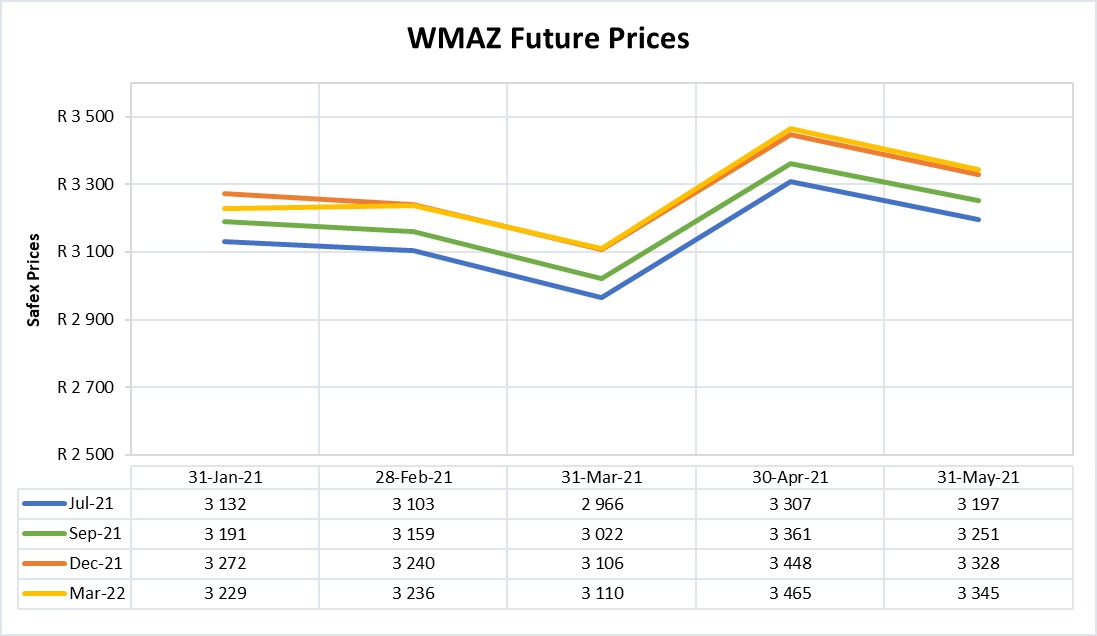

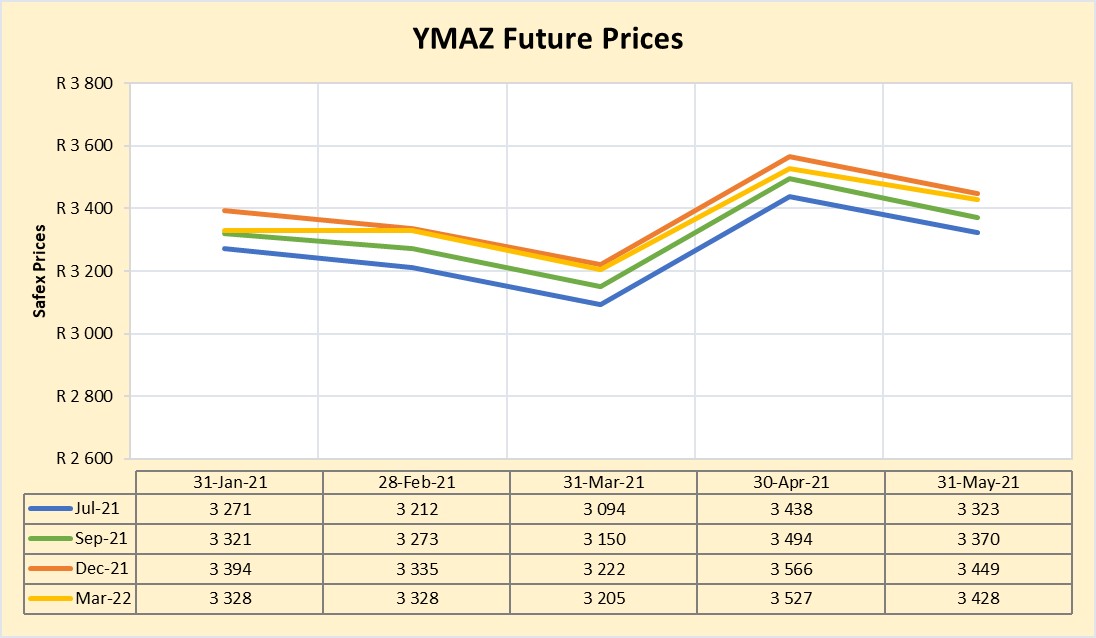

Graphs 16 and 17 illustrate the market sentiment for maize, in the form of future contracts, for the upcoming contract months.

The market sentiment is the expectation of supply and demand fundamentals relating to white and yellow maize in South Africa.

Source: Sagis

Source: Sagis

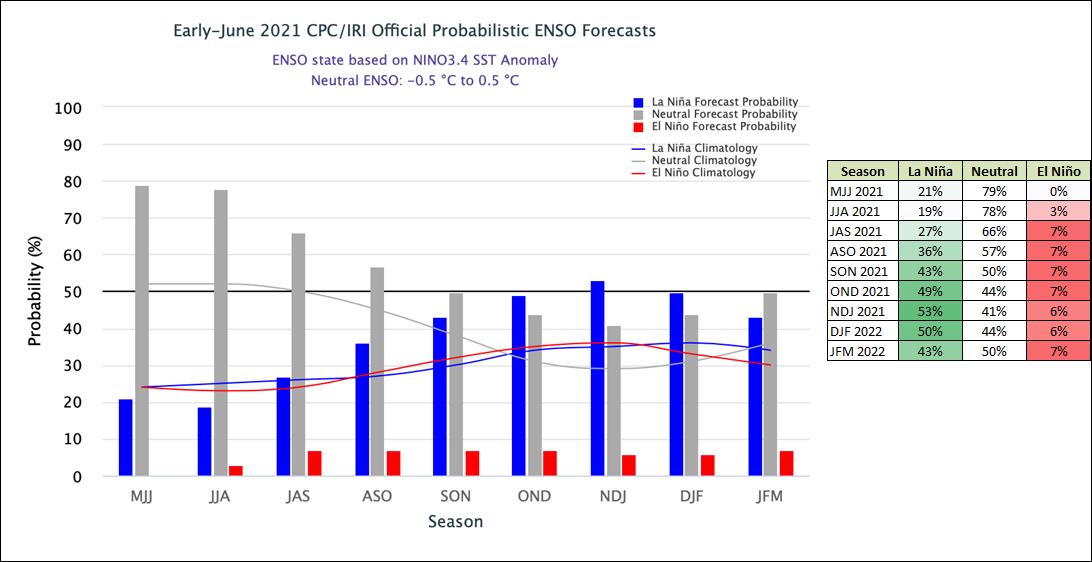

2.2 Weather and climate

Graph 18 shows that ENSO-neutral conditions continued during May, with near-average sea surface temperatures observed across most of the equatorial Pacific Ocean. Sea surface temperatures (SST) remained positive but decreased slightly due to the weakening of above-average subsurface temperatures.

La Niña chances increase to near 50% during the month of October 2021 until February 2022.

Source: International Research Institute for Climate and Society

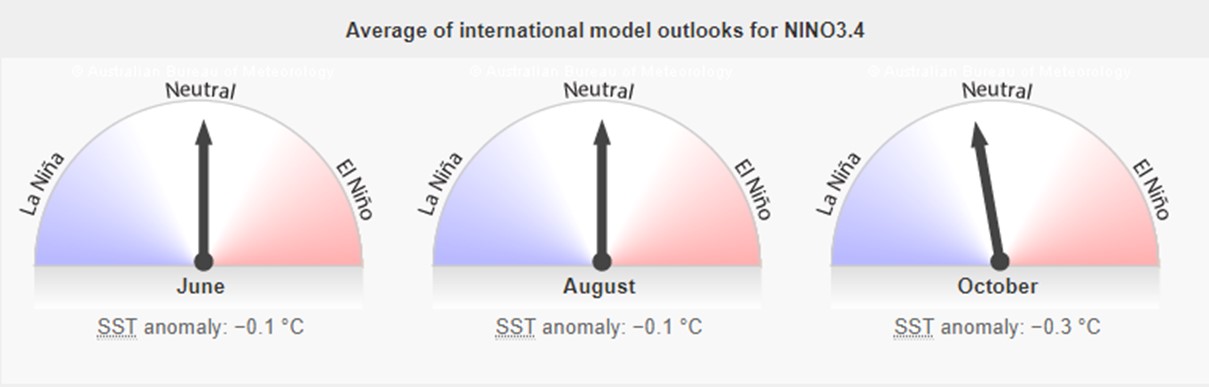

The El Niño-Southern Oscillation (ENSO) is neutral. The model outlooks for NINO 3.4 indicates that it will remain neutral until at least mid-spring (Graph 19).

2.3 Interest rate risk

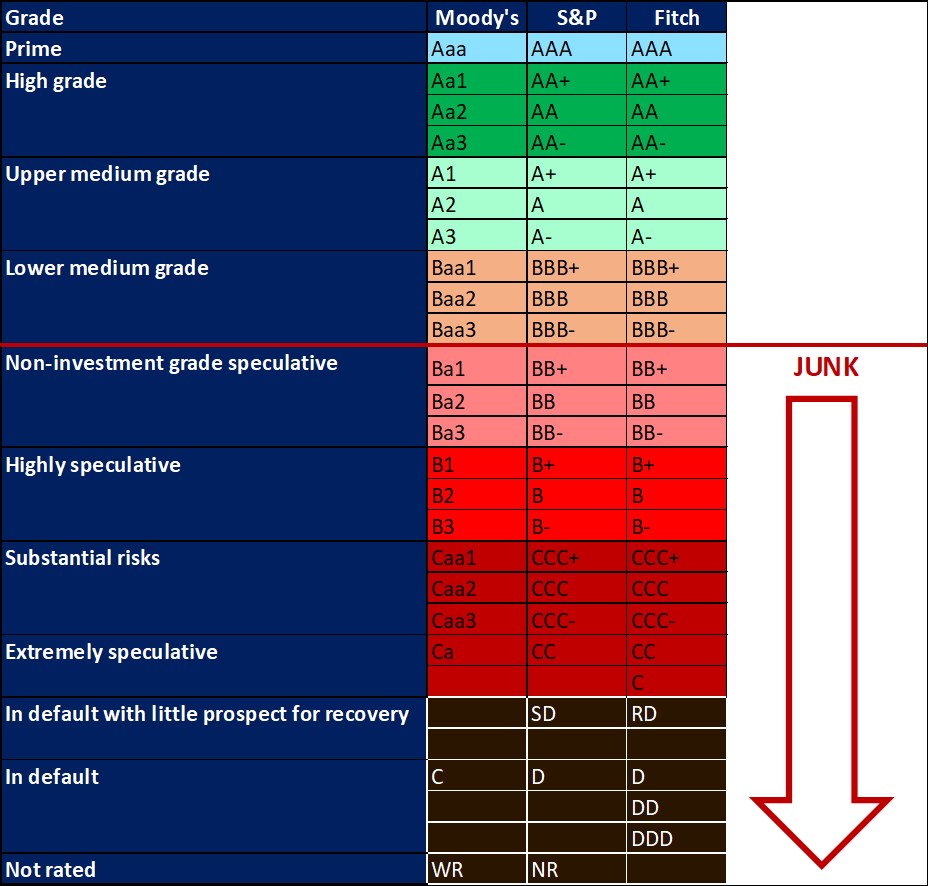

On 27 March 2020, Moody’s downgraded South Africa’s sovereign credit rating to sub-investment grade and placed a negative outlook on the rating. The key drivers for this downgrade include weak economic growth, continuing deterioration in fiscal strength, and slow progress on structural economic reforms. It is now the first time in post-apartheid South Africa where all major rating agencies, that is Moody’s, Fitch and S&P, have South Africa’s credit ratings in sub-investment grade territory.

The COVID-19 pandemic has forced the South African Reserve Bank to make a number of interest rate cuts to bring relief to the economy. Interest rate movement:

- 20 March – 8,75%

- 15 April – 7,75%

- 22 May – 7,25%

- 23 July – 7,00%

Since the Monetary Policy Committee meeting in July 2020, the interest rate has remained unchanged.

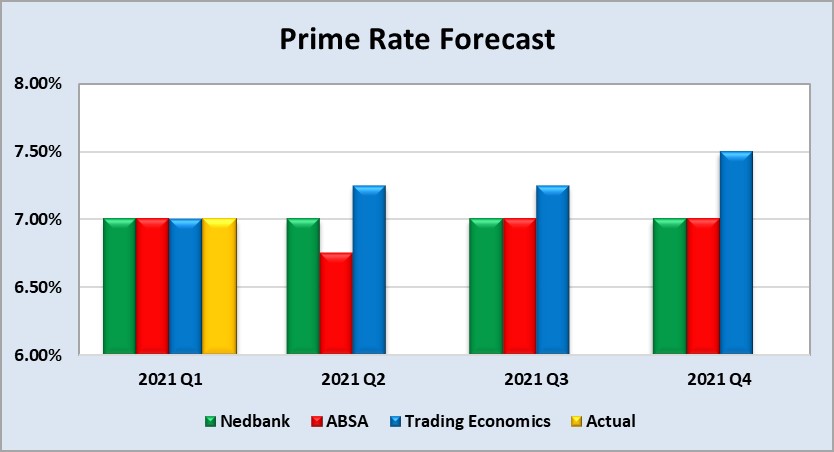

Graph 20 shows the prime rate forecast for 2021 Quarter 2 to 2021 Quarter 4. Absa forecasts that the prime interest rate will be cut by a further 25 basis points. The next MPC meeting date is 22 July 2021.

3. FRAUD RISK

3.1 Fraud awareness

SymQuest believes that business data is more vulnerable than ever before. Cybersecurity is necessary for any business to efficiently operate. It is also critical for protecting your customers’ information.

Following IT best practices goes beyond using the latest technology; it’s about staying ahead of risks and disasters. When creating cybersecurity procedures, SymQuest suggests using a layered security model. This model begins with the internet and ends with the company employees. The fourth point in this layered security model that will be referred to is anti-virus/malware updates. In the coming reports, additional points of the model will be included.

With cybersecurity becoming such an important component of almost any business The Committee of Sponsoring Organizations of the Treadway Commission (COSO) plans to issue detailed recommendations on how organisations can better manage risks related to cloud computing, artificial intelligence and outside contractors, among other topics in the year ahead.

The final version of the Cybercrime Bill is also completed and ready to become law. The law will effectively deal with cybercrimes.

3.2 Fraud tip

The fraud prevention tip for this month is: Make employees aware – set up a reporting system.

Awareness is applicable to all employees. Those who are planning to commit fraud will hopefully be deterred by the idea that management is watching. Honest employees will also be made aware of possible signs of fraud or theft. These employees are assets in the fight against fraud. According to the Association of Certified Fraud Examiners (ACFE) 2014 report, most occupational fraud (over 40%) is detected because of a tip. While most tips come from within the organisation, other important sources of tips are vendors, customers, competitors and acquaintances of the fraudster.